The Top Shopping Apps of 2025: Breakout Stars to Category Mainstays

2025 was another year of explosive evolution in ecommerce - and specifically for mobile apps.

We broke down the data to find out the fastest growing shopping apps of 2025, the apps that exploded onto the scene, and the apps that remain at the top of the download charts year after year.

All together, this data gave us our first-ever top 25 shopping apps of the year list.

In the past year, a few apps grew faster than anyone expected. The giants held their ground. And some categories - live shopping, resale, quick commerce - went from niche to mainstream.

Methodology

How We Built This List

There's no official "top shopping apps" ranking. App Store and Google Play charts change daily. Download numbers are estimates. Revenue figures are often private.

So we built our own methodology.

What we looked at:

- Consistency in the top 100. We tracked how many months each app held a position in the US shopping category top 100 (iOS and Android combined). An app that ranked #15 for 12 straight months tells a different story than one that spiked to #5 for a week and disappeared.

- Year-over-year rank movement. Where did the app start in January 2025? Where did it end in December? Apps that climbed (like Whatnot, from #2 to #1) got weighted differently than apps that held steady or slipped.

- Peak ranking. The best position an app hit during the year. This captures breakout moments. Even if an app didn't sustain the peak, hitting it matters.

- Download growth. Where available, we looked at year-over-year download growth rates. Whatnot's 541% growth and Blinkit's 165% growth are the kinds of signals that separate breakouts from steady performers.

- Category dominance. Some apps own their category. Vinted in resale. Klarna in BNPL. Sole Retriever in sneakers. We weighted apps that clearly led their segment, even if their overall rank was lower than generalist competitors.

Data sources:

- Appfigures (real-time App Store and Google Play rankings)

- Sensor Tower (quarterly download and revenue estimates)

- Statista and Business of Apps (industry benchmarks)

- Company disclosures (funding rounds, GMV, MAU where reported)

Limitations:

This is a primarily US-focused ranking. Global performance (like Blinkit's dominance in India or Temu's reach across six continents) is noted but not the primary lens.

Some apps don't report download numbers publicly. Where exact figures weren't available, we used ranking consistency and third-party estimates as proxies.

Revenue data is often proprietary. We prioritized publicly reported figures and analyst estimates from reputable sources.

Top 25 Shopping Apps in 2025

Here it is: our inaugural top shopping apps ranking.

Now let's dive deeper into the list, with our mobile commerce experts' breakdown on where each of these apps stand out, and how they fit into the overall mobile commerce landscape.

The Breakout Apps

These three apps didn't just grow. They changed what people expect from shopping on their phones.

Whatnot

The numbers: 541% year-over-year download growth. $6 billion in gross merchandise value (up from $3 billion in 2024). 1.61 million new installs in November 2025 alone. Valuation went from $4.97 billion to $11.5 billion in one year.

The stat that stands out: users spend 80 minutes a day on Whatnot. That's more than Netflix.

What happened: Whatnot started as a platform for collectibles - Funko Pops, trading cards, vintage toys. Stuff that passionate collectors care about. The kind of products where a knowledgeable seller explaining what makes something special actually matters.

In 2025, that model went way beyond collectibles. They expanded to 15+ categories: food, cars, luxury goods, wholesale. Each category got dedicated teams. The format stayed the same; live auctions with real sellers who know their stuff; but the audience got a lot bigger.

Why Whatnot was successful:

- Community over commerce. Whatnot sellers aren't anonymous storefronts. They're enthusiasts with followings. Buyers come back for the sellers, not just the products. The platform's reward program drives a 20% lift in repeat purchases.

- Discovery over search. Whatnot is designed around stumbling onto things. They have an "and whatnot" section (basically uncategorized stuff) where new categories emerge on their own.

- Entertainment value. The live format turns shopping into content. 80 minutes a day is habit-forming.

- AI in the background. They use AI for product recognition, listing creation, and fraud detection. But the sellers are still real people. Some platforms tried AI-hosted streams; Whatnot kept humans front and center.

The takeaway: Live shopping works at scale. It combines community, entertainment, and commerce in ways regular ecommerce can't.

Learn more: What is Whatnot? The Live Shopping App Exploding in 2025

Vinted

The numbers: 36% revenue growth. Named Best Retail App 2025 in the UK. Part of a US secondhand market that hit $56 billion+ and grew 14% year-over-year.

What happened: Resale has been growing for years. But 2025 was the year it really hit mainstream, and Vinted was at the front.

Their zero-fee model undercut Poshmark and Depop. Sellers keep more. Buyers pay less. The economics work for everyone.

Beyond pricing, two things drove it: sustainability and affordability. Both are real concerns for younger shoppers, and both point toward secondhand.

Why Vinted was successful:

- Gen Z economics. Younger consumers are dealing with higher costs and flat wages. Secondhand isn't settling, it's smart.

- Sustainability matters. Climate concerns moved from niche to mainstream. Buying secondhand feels better than fast fashion.

- Zero fees. Most resale platforms take a cut. Vinted doesn't charge sellers. That simple difference brings in more listings, which brings more buyers, which brings more sellers.

- Built for phones. Listing an item takes seconds. Browsing feels like scrolling social media.

The takeaway: Resale isn't going away. The market has a long runway, and the winners will be the platforms that make selling as easy as buying.

Blinkit

The numbers: 165% download growth from January to October 2025. Topped global ecommerce download growth for the year.

What happened: Blinkit is an instant delivery app owned by Zomato. Their promise: groceries and essentials in 10 minutes. In India's dense urban markets, it worked. Really well.

Why Blinkit was successful:

- 10-minute delivery. At that speed, the app becomes more like a convenience store in your pocket. Forgot milk? It's there before you finish making coffee.

- Deep local integration. Blinkit didn't just do groceries. They added pharmacies, local services, lifestyle stuff. The app became a daily utility.

- Emerging market dynamics. India didn't go through the same ecommerce phases as the US. Consumers went straight to mobile-first shopping.

- Unit economics that actually work. Quick commerce has killed a lot of startups. Blinkit figured it out: small local warehouses, hyper-local delivery, enough order density to make the math work.

The takeaway: Quick commerce is real. It's mostly an emerging-market story right now, but it's starting to show up in US cities.

The Mobile Commerce Giants

These apps didn't have breakout years. They didn't need to. They're already at the top, and they stayed there.

Temu

The numbers: 1.2 billion cumulative downloads. 530 million monthly active users (August 2025 peak). #1 global shopping app for the third consecutive year.

Temu dominated in North America, Latin America, the Middle East, Africa, Japan, and South Korea. In Q1 2025, US monthly active users grew from 69 million to 81 million+.

Why it works: Ultra-low prices. Direct manufacturer connections. Over $2 billion a year in marketing spend. It's a hard model to compete with on price.

SHEIN

The numbers: 74 million downloads in the first half of 2025. 5.3 million US downloads between June and August. Estimated 2025 revenue: $58.5 billion.

Why it works: Algorithm-driven supply chain with 7-day production cycles. Thousands of new items every week at ultra-low prices. Despite ongoing controversies around labor, environmental impact, and IP issues, the download numbers keep climbing, especially among price-conscious Gen Z shoppers.

Read more: How Shein and Temu Leverage Mobile Apps to Keep Users Hooked

Amazon Shopping

The numbers: 105+ million monthly active users. $5-5.8 million in weekly revenue. Consistent market leader.

Why it works: Prime ecosystem. Same-day delivery. Easy returns. For a lot of shoppers, the convenience is worth paying a bit more. The app is a loyalty tool as much as a shopping tool.

Learn more: 37 Incredible Amazon Statistics

Walmart

The numbers: 64+ million monthly active users. 380K-440K weekly downloads. Consistent top 5.

Why it works: Omnichannel execution; online ordering, in-store pickup, grocery delivery. Walmart has the logistics infrastructure to compete with Amazon on convenience, plus physical stores everywhere.

Strong Performers & Category Leaders

These apps held steady positions throughout the year. Not explosive growth, but consistent performance in their categories.

Shop (Shopify)

Position: Consistent top 3 in app downloads

Shopify's consumer-facing app aggregates orders from Shopify-powered stores. It benefits from the strength of the Shopify ecosystem. As more brands use Shopify, more customers use Shop for tracking and discovery.

AliExpress

Position: Consistent top 5 in app downloads

Alibaba's consumer marketplace. Similar positioning to Temu; low prices, direct from manufacturers; but with a longer track record and broader category coverage.

eBay

Position: Consistent top 10 in app downloads

The original online marketplace. eBay's auction format and broad category coverage still serve a distinct audience. The platform has been around long enough that many users have years of purchase history and seller relationships.

Etsy

Position: Consistent top 15 in app downloads

Handmade and vintage marketplace. Etsy benefits from the creator economy and the desire for unique, non-mass-produced goods. It's a different value proposition than the discount marketplaces.

Depop

Position: Consistent top 10 in app downloads

Fashion-focused resale with strong community features. Popular with younger shoppers who treat it more like a social platform than a traditional marketplace. Mobile-first design.

Klarna

Position: Consistent top 15 in app downloads

The leading buy-now-pay-later app. Klarna has evolved beyond just payments - it now includes marketplace and discovery features. BNPL is becoming part of the shopping experience, not just the checkout.

Capital One Shopping

Position: Consistent top 15 in app downloads

Deals and cashback app that automatically finds coupons and price drops. The value proposition is simple: use the app, save money. Automatic coupon application removes friction.

Fetch Rewards

Position: Consistent top 15 in app downloads

Rewards app with grocery integration. Users scan receipts to earn points. The automatic scanning and consistent rewards create a habit loop that keeps people coming back.

Fast-Growing Resale Apps

Resale was one of the fastest-growing categories in 2025. Beyond Vinted and Depop, several other apps held strong positions.

Mercari

Position: Top 50, growing

Broad category resale platform. More general-purpose than fashion-focused Depop or Poshmark. Mobile-first with a clean interface.

Poshmark

Position: Consistent top 30 in app downloads

Fashion resale with strong social features and seller community. Poshmark sellers often build followings and treat the platform like a side business. The community aspect creates loyalty.

Buy Now, Pay Later

BNPL became embedded in the shopping journey in 2025. These apps aren't just payment tools anymore. They're becoming shopping destinations too.

Affirm

Position: Consistent top 20 in app downloads

Flexible payment options with expanding merchant partnerships. Affirm has been adding more features to keep users in the app beyond checkout.

Afterpay

Position: Consistent top 30 in app downloads

Part of the Square ecosystem. Similar model to Klarna and Affirm - split payments into installments, integrated with merchant checkout flows.

Big-Box Retail

Traditional retailers with strong logistics and omnichannel capabilities held their positions. Their apps serve as loyalty and convenience tools.

Target

Position: Consistent top 20 in app downloads

Target's app integrates with in-store pickup, same-day delivery (via Shipt), and the Target Circle rewards program. The app makes the omnichannel experience smoother.

Best Buy

Position: Consistent top 25 in app downloads

Electronics-focused retail. Best Buy's app is useful for price checking, inventory lookup, and leveraging their Geek Squad services. Tech-savvy shoppers use it for research as much as purchasing.

The Home Depot

Position: Consistent top 25 in app downloads

Home improvement retail. The app benefits from the DIY trend and the complexity of home improvement shopping - checking product specs, inventory availability, and project planning.

Circle K

Position: Consistent top 10 in app downloads

Convenience and fuel retail. Circle K's app integrates fuel rewards, in-store deals, and payment. For frequent customers, the app becomes part of daily routine.

Niche Players

Sometimes serving a specific audience really well beats trying to serve everyone.

Sole Retriever

Position: Top 100 (niche category leader)

Sneaker-focused app for tracking raffles, drops, and releases. If you're serious about sneakers, Sole Retriever does things the big marketplaces never will: real-time drop alerts, raffle tracking, release calendars.

Alibaba.com

Position: Consistent top 10 in app downloads

B2B marketplace connecting businesses with manufacturers and wholesalers. Different audience than consumer apps, but massive in its category.

What the Winners Have in Common

Looking across all 25 apps, a few patterns stand out.

Engagement Over Transactions

The apps that grew fastest aren't just optimizing for checkout. Whatnot wants 80 minutes of your day. Vinted wants you browsing like a social feed. Blinkit wants you opening the app daily.

They're building habits, not just completing sales.

Community and Trust

Whatnot sellers have followings. Vinted and Poshmark sellers have ratings and histories. Even the big-box apps build trust through consistency - same prices, same delivery promises, every time.

Anonymous, transactional experiences are losing to platforms where people feel a connection.

Mobile-Native Design

The breakout apps were built for phones first. Not adapted from desktop. The experience feels natural to how people actually use their devices.

Retention Mechanics

Push notifications. Rewards programs. Daily use cases. The winning apps have reasons to come back built in, not just reasons to buy once.

What This Means for Ecommerce Brands

Most of these apps are marketplaces or platforms; not direct competitors to independent, DTC ecommerce brands.

But brands can apply the same lessons behind their success.

Your best customers want more than a checkout page. They want an experience worth returning to. They want convenience that fits their life.

A mobile app, with push notifications, faster performance, and home screen presence, is one of the best ways to give them that.

The brands treating mobile as a core channel are the ones set up to grow the fastest in 2026.

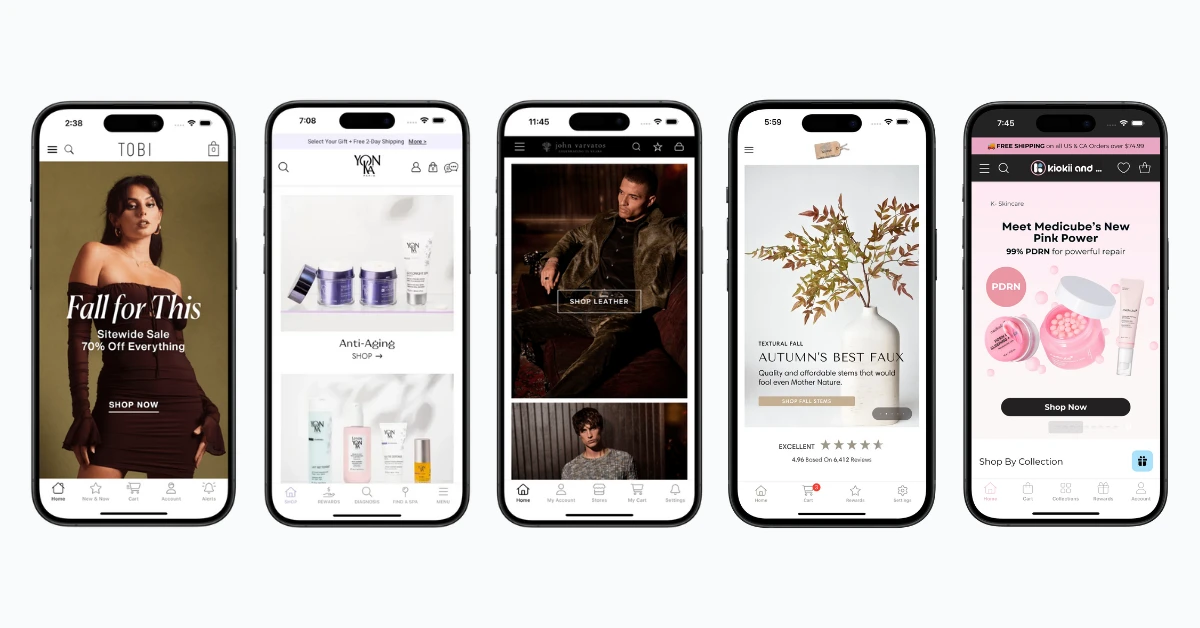

Build Your Mobile App with MobiLoud

These apps show what's possible when mobile is done right: engagement, retention, and revenue that builds over time.

MobiLoud helps ecommerce brands launch mobile apps without months of development or big budgets.

Your website powers your app. Same products, same checkout, same design, synced automatically.

You can send zero-cost push notifications, including automated abandoned cart notifications that recover lost revenue on autopilot.

Want to see what’s possible? Get a free, no-obligation preview of your app and walk through the process to turn it into a powerful mobile app.

FAQs

Convert your website into a mobile app